Article by Matthew Cranston, courtesy of The Australian.

02.10.2025

Businesses now rank the cost of energy as the chief concern for their future, rating it almost three times more worrying than US tariff and trade disruptions, according to new analysis.

Several corporate leaders, including those in the manufacturing sector, say the cost of energy is rising so fast that it’s now risking their competitiveness with importers, while about 19 per cent of businesses expect to use AI to “reduce headcounts”.

Their concerns follow BHP chief executive Mike Henry and BlueScope boss Mark Vassella lashing out at high energy prices, along with companies such as Orica, Incitec Pivot, Boral and Wesfarmers.

Of the 526 companies surveyed, software accounting firm MYOB found the biggest concern was energy bills, followed by inflation. The level of concern on energy was three times more prevalent than worries over changes to tariffs and international trade disruptions and uncertainty, and more than seven times more concerning than cyber attacks.

MYOB chief executive Paul Robson said rising energy costs were clearly a problem.

“The research signals rising energy costs are the most significant challenge facing Australia’s mid-sized businesses today,” Mr Robson said.

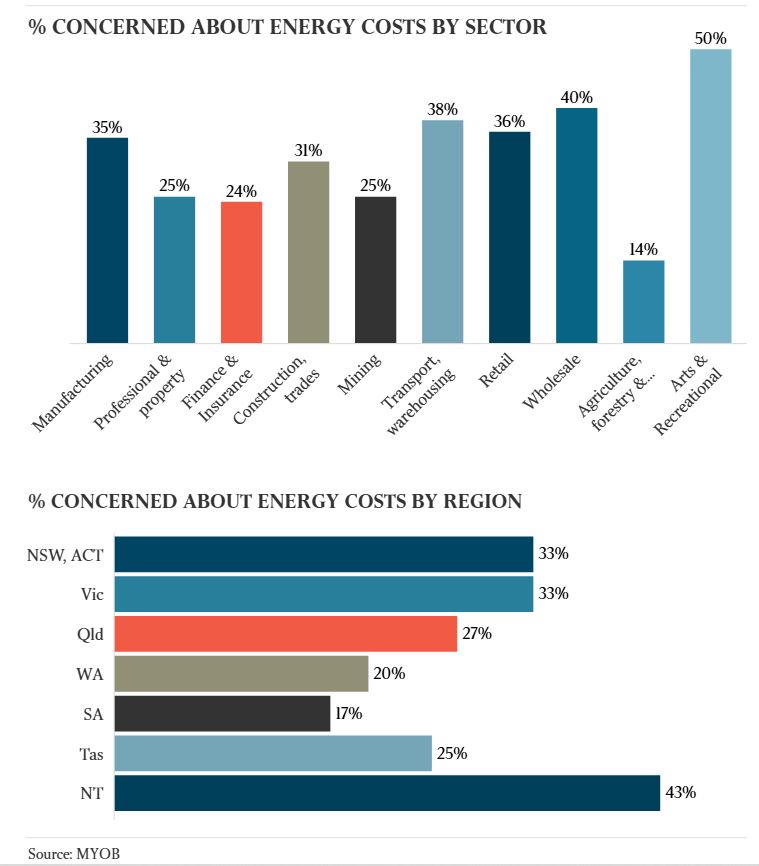

The concerns over energy costs were felt most in manufacturing, transport and warehousing, wholesale trades, recreational services, and with companies that have between 200 and 500 employees. Victoria and NSW were the states where energy costs were of the highest concern, while Western Australia recorded the lowest levels.

In the Melbourne suburb of Dandenong South, the managing director of metals component manufacturer Abeck Group, Peter Angelico, said he was angry with the rapid rise in energy bills and the government’s reaction to the problem.

“They talk about energy costs but they never add in all the other energy-related charges that are going up, such as transmission and environmental charges,” Mr Angelico told The Australian.

“Just look at the last four years – I don’t know where they get the idea that costs are going to come down. I am concerned that this will keep going up, and that makes me uncompetitive with the importers,” he said.

Abeck makes everything from ladders used on oil rigs to cooling pipes on locomotives.

BHP’s Mr Henry told a shareholder forum last month: “The reality is … Australia has electricity costs that are two to three times higher than countries that we are competing with and 50 to 100 per cent higher than the US.”

The chief executive of data centre owner NEXTDC, Craig Scroggie, said higher energy costs were crimping Australia’s competitiveness. “No one is happy with higher energy costs, especially when the government says they are going to be low. For Australia to be competitive globally we need clean, firm and cheap electrons, but at the moment we are certainly not getting cheap ones.”

All around Australia, companies include energy costs among the challenges faced doing business. Wesfarmers management said last month during its results reporting that “domestic cost pressures are expected to persist in the 2026 financial year, driven by labour, energy and supply chain costs”.

“To mitigate these impacts, the divisions will continue to execute productivity initiatives, including investments to digitise operations and increase the use of AI to support growth and efficiency,” the company said.

The MYOB survey shows 25 per cent of businesses are concerned about employment costs and 19 per cent have used AI to “reduce headcounts” this year.

An extraordinary 75 per cent of the mining companies surveyed said they had used AI to reduce headcounts, while 33 per cent of arts and recreational services said they had also used it to cut jobs.

Asked which of the following areas businesses were most open to using/applying AI or automation in the next 12 months, an equal 40 per cent of them said they would use it for sales and customer relationships and payroll and workforce management. More than 40 per cent of businesses that had used AI in the last 12 months reported productivity gains.

A mere 9 per cent of the companies surveyed said they had concerns about international trade disruptions and uncertainty.

“While most of our survey respondents indicate they expect little to no impact from the recently confirmed US export tariffs, it remains a concern for those who do export to the United States,” MYOB’s Mr Robson said.

“Mid-sized business leaders who export are taking steps to minimise exposure to risks by locking in supply costs, revisiting overseas agreements and contracts, and diversifying into new markets,” he said.

About 15 per cent of businesses said they had concerns about consumer confidence falling.

The official household spending indicator, released by the ABS on Thursday, rose just 0.1 per cent in August, weaker than economists consensus estimate at 0.3 per cent. ANZ-Roy Morgan Consumer Confidence figures released on Tuesday this week showed a level of 86.5 points, still lower than the average 109.4.