Article by Paul Garvey and Sarah Ison, courtesy of The Australian

05.08.2025

Andrew Forrest’s Fortescue secured hundreds of millions of dollars in government commitments, incentives and subsidies for clean-energy projects, including ventures since abandoned, underscoring the challenge facing the Albanese government in its efforts to fast-track the renewable energy transition.

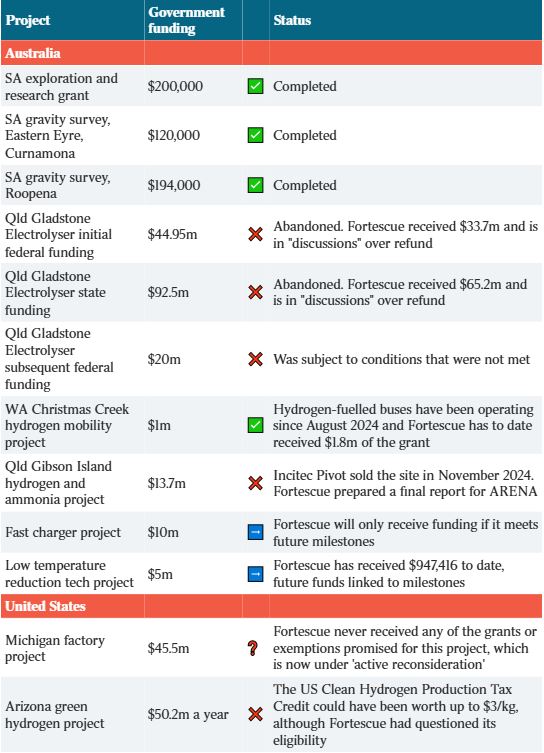

The $55bn iron ore miner and its associates have received grants and commitments worth almost $190m from state and federal governments in Australia alone, including more than $110m for the Queensland hydrogen plans scrapped by the company in recent weeks.

The government assistance does not include money spent developing infrastructure to support Fortescue’s projects, such as the $1bn spent on a water pipeline to Gladstone that was earmarked for use by green hydrogen projects.

The funding promises and incentives were secured by Fortescue and its partners at the same time as the miner paid out tens of billions of dollars in dividends, including more than $13bn in dividends to company founder Dr Forrest and his ex-wife Nicola.

The chief executive of Fortescue Metals and Operations, Dino Otranto, said the company had received $115m in grants since 2019 – just a small fraction of the $39bn in taxes and royalties it had paid over that time.

Fortescue future industries hydrogen project status

It was also a sliver of what he said were the $14.5bn in “subsidies to fossil fuel giants” in 2023-24.

“We shouldn’t expect those who take on the challenge of building something new to go at it alone – it’s a co-investment in Australia’s economic growth,” Mr Otranto said. “Government grants are a necessary investment to drive innovation, create jobs and position Australia at the forefront of global decarbonisation.

“Fortescue is leading the global effort to decarbonise heavy industry, developing and deploying technologies that don’t yet exist at commercial scale. We are building a new industry from scratch, which comes with risk – but without risk, there is no progress.”

The company’s decision to pull the pin on its Queensland hydrogen electrolyser efforts sparked calls for Fortescue to hand back the state and federal taxpayer assistance it received for the project.

The company confirmed it had received $33.7m of the $44.5m of federal assistance promised for the Queensland project under the Modern Manufacturing Initiative, and $65.2 of $92.5m of Queensland government funding. It is in discussions with both the state and federal governments and “will return funds where required” under the grant agreements.

“The reality is not every investment delivers immediately and there are setbacks,” Mr Otranto said. “What matters is backing those with the ambition to try and the track record of delivering real value for the nation.

“We won’t decarbonise heavy industry, tackle climate change, or build the next great Australian success story by playing it safe.”

A spokeswoman for Dr Forrest said Fortescue and his private companies Tattarang and Minderoo foundation were focused on “building a stronger Australia and leaving the planet liveable for future generations”. “Together, they reflect Dr Forrest’s commitment to investing in Australia and for Australians,” she said.

Minderoo, she said, had dedicated more than $700m over the past three years to early childhood development, crisis response, helping communities, rare cancer research, delivery of humanitarian aid and ocean conservation.

Among the bigger grants received by Fortescue in Australia was $13.7m from the federal Australian Renewable Energy Agency towards a study for a green hydrogen and ammonia project at Gibson Island in Queensland. Fortescue completed the study and provided a final publicly available report to ARENA. Incitec Pivot has since sold the site.

ARENA also awarded Fortescue a $10m grant towards the development of fast-charger test units compatible with the miner’s electric mining equipment. Fortescue is yet to receive any of that grant funding, which is tied to future milestones and incurred costs.

ARENA also promised to tip in $5m for Fortescue’s $42.57m development of an electrolyser to help in the production of green iron and steel. That program is scheduled to wrap up in March 2026, and Fortescue has to date received just under $1m of the promised funding.

The CSIRO directed $2m towards Fortescue’s plan to replace its diesel-fuelled buses at Christmas Creek with 10 hydrogen-powered coaches. That program cost $33.8m in total, and the hydrogen buses have been operational since 2023. Fortescue has collected $1.8m of the grant so far.

The mining heavyweight has also been the recipient of some modest grants from the South Australian government towards its early-stage minerals exploration in the state. Those grants were made under SA’s Accelerated Discovery Initiative, in which the state and companies each contribute 50 per cent of the funding.

Arguably the biggest government incentives dangled in front of Fortescue never made it to the company, with the company’s $US550m ($852m) Arizona green energy project formally abandoned and its Michigan battery factory looking increasingly unlikely. The US Clean Hydrogen Production Tax Credit would have been worth up to $US3 per kilogram of hydrogen production – the equivalent of more than $50m per year under Arizona’s proposed output – but there were question marks over Fortescue’s eligibility for the scheme and policy uncertainty from the Trump administration was the final nail in the project’s coffin.

Back in Australia, a federal government spokeswoman noted that ARENA made grant decisions independent of government.

“The government is backing Australian innovation – and ensuring bang for buck for taxpayers by requiring projects to deliver milestones before unlocking funding as well as knowledge sharing as projects progress,” she said.

Most of the grants secured by Fortescue were funded under the Morrison government.

Opposition energy spokesman Dan Tehan said the taxpayer rightfully demanded value for money when such grant programs were being rolled out.

“In any good program, value for money for the taxpayer is always evaluated, and if it’s not being delivered, either needs to be adjusted or abolished,” he said. “If we are repeatedly funding projects which failed to be delivered, the taxpayer rightfully deserves much better.”

Fortescue is by no means the only large company to secure government assistance. Netherlands-headquartered Nyrstar on Tuesday secured a $135m rescue package from the federal, SA and Tasmanian governments to help keep its struggling smelters in Port Pirie and Hobart running.

Oil and gas producer Woodside Energy secured a $26m commitment from the West Australian government for carbon capture and storage efforts as part of its Burrup Hub project, as well as a $10m grant for its H2Perth hydrogen refuelling project in Rockingham. And a joint venture of Woodside, BlueScope, BHP, Rio Tinto and Mitsui won a $19.8m grant for its NeoSmelt green iron project, also in WA.

The Queensland government this year announced $21m of funding to support four gas exploration projects in the Bowen Basin. Victoria put $15m towards a Japanese program to produce hydrogen from brown coal.

Senior Fellow of the Energy Program at Grattan Institute, Tony Wood, said the government needed more “discipline” around the grant process and to be investing less money in more projects.

“Grant-based funding is a good approach for early stage technology, where the money involved is modest,” he said. “Rather than helping deploy full-scale commercial technologies, you want the government to invest in a suite of technology, all of which prove before the event they have potential to deliver. Otherwise they shouldn’t be supported.”