News

Iron ore was a game of two halves in 2021. There’s reason for both pessimism and optimism in 2022

If ever there was a game of two halves it was iron ore in 2021. The first half of the year was something we’ve never seen before and may never see againProfits and dividends went through the roof. Australia’s biggest five iron ore miners — BHP (ASX:BHP), Rio Tinto (ASX:RIO), Fortescue Metals Group (ASX:FMG), Roy Hill and Mineral Resources (ASX:MIN) paid out $59.5 billion for the year to June 30. Gina Rinehart, Australia’s richest person, banked $3.92 billion from Roy Hill alone, after the 60Mtpa miner delivered $5.6b to shareholders. Hancock Prospecting’s Atlas Iron business, on death’s door as a listed entity a few years ago, raked in more than $900 million profit as Hancock declared a $7.3 billion profit — a record for a private company and larger than three of the four big banks.

Record $379bn earnings forecast for resources, energy export

Minister for Resources and Water Keith Pitt said that the resources sector once again has been shown to be the bedrock of the Australian economy and would strongly support the nation’s future growth. “The resources sector has risen above the challenges of the pandemic and will continue to deliver for our nation in the years ahead,” Minister Pitt said. “In 2020–21 our resources and energy earnings passed $300 billion for the first time, reaching $310 billion, and are now forecast to top that by $69 billion in 2021–22. “These are outstanding results that will provide further jobs and opportunities in our regions and benefit all Australians.

Rinehart backs carbon tech play

A TECHNOLOGY that uses renewable energy-powered electrolysis at low temperature to convert carbon dioxide into reusable carbon and oxygen has been backed by Gina Rinehart’s Hancock Prospecting. Called Carbelec, the technology is being developed by researchers at the University of Melbourne. Those researchers claim the technology could be a game changer for steel makers.

This is a very important read. I have read it twice…

When I saw the title of this lecture, especially with the picture of the scantily clad model, I couldn’t resist attending. The packed auditorium was abuzz with questions about the address; nobody seemed to know what to expect. The only hint was a large aluminum block sitting on a sturdy table on the stage.

Iron ore miners and bankers keep budget afloat

Iron ore miners and the nation’s banks are carrying the federal budget, with corporate tax figures revealing the assault on big technology companies is failing to deliver huge increases in revenue.Total tax from the mining sector increased to $25 billion in 2019-20, making it the most valuable to the federal budget. Most of it came out of iron ore producers such as Rio, BHP and Fortescue as the iron ore price lifted strongly. In 2015-16, miners paid $6.3 billion.

Resources and energy export earnings continue to rise

Australia’s resources and energy exports continue to surge, latest trade data confirmed today, despite the challenges of the past 12 months “The resources and energy sector already provides direct jobs for around 268,000 Australians and support the employment of over a million more. “The growth shown in these earnings across the sector simply means more jobs and more opportunities for Australia,” Minister Pitt said.

Twiggy’s rebate idea dead

But Mr Littleproud, said the proposal was dangerous and didn’t make sense. He said diesel users who didn’t use public roads should not have to fork out the excise to pay for maintaining them. “Why would you constrain an industry? Why would you take away its competitiveness and effectively take away its jobs? “And while Twiggy might be able to afford it, I don’t know whether every Australian out there that’s employed by some of these other industries can afford it and will want to see their jobs go because we’re not competitive.” Miners and farmers also slammed the proposal, saying it would cost investment and jobs because there is no widely available substitute fuel to power their operations.

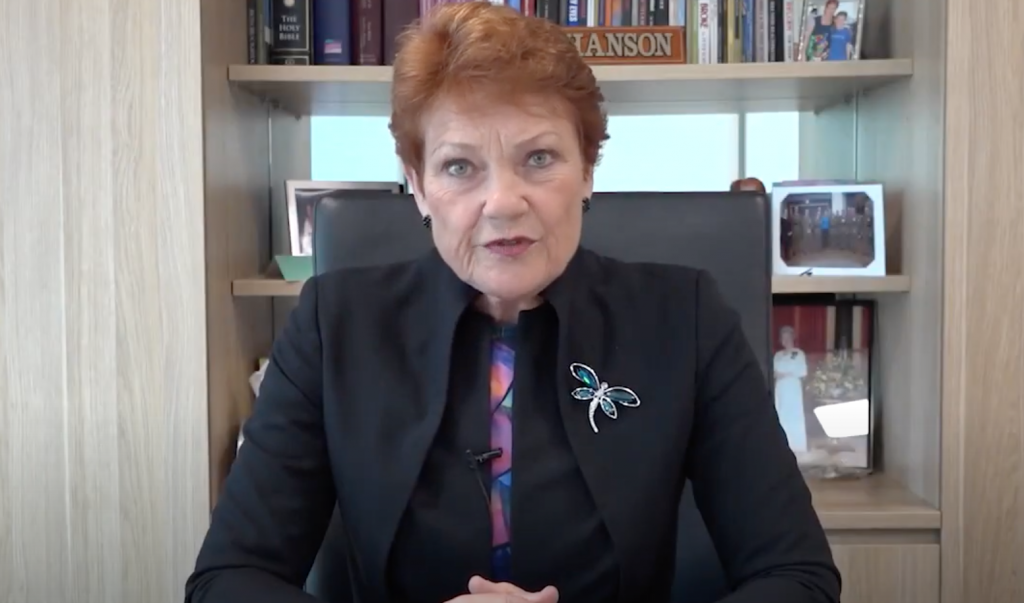

Gina Rinehart renews red tape warning for new mining projects as Atlas Iron profit skyrockets

“The importance of mining to Australia has never been more evident than during the 2020/21 financial year, a time in which I am immensely proud of Atlas and our people and their contribution to safeguarding the economic prosperity of West Australia and Australia,” Ms Rinehart said. “The mining industries and the businesses they support help to support millions of Australians right across the country. “When mining does well, so does Australia. We just have to remember that Australia exports its ore internationally, so we have to be cost competitive internationally, hence we should be wary of onerous government cost burdens, that don’t encourage investment.

Australian resources and energy keep export dollars flowing

“These latest quarterly figures show Australia’s resources are the gifts that keep on giving,” Minister Pitt said. “Our resources exports continue to bring hundreds of billions of dollars into the country and keep thousands of Australians in high-value, high-skilled jobs – particularly in regional Australia. “Just as iron ore’s incredibly strong run cools, soaring demand for our coal and liquefied natural gas is fuelling a surge in export revenues.

IS NUCLEAR THE ZERO HERO?

Unlike many other countries, Australia has enjoyed an abundance of coal and more recently gas to provide a considerable chunk of its energy needs. But in the global push to decarbonise and the widely accepted goal of net zero by 2050, the fossil fuels we have traditionally relied on have become part of the problem. While renewable energy such as solar, wind and hydro, supported by batteries, are seen as playing a greater role in Australia’s new energy mix, providing reliable baseload power without fossil fuels remains a conundrum. And that’s where advocates of nuclear power come in.