News

Why this rock could push the budget into the black

The budget bottom line is set to benefit from billions of dollars in extra tax collections due to iron ore prices, economist predict, which will likely deliver a second surplus for the Albanese government.

Bullish mining CEOs flag challenges ahead

The chief executives of the country’s largest miners are looking to 2024 with optimism with Australia in a prime position to take advantage of the global demand for resources but they warn there are challenges ahead.

Iron ore rally bolsters $A prospects in 2024

An almost 30 per cent surge in the iron ore price to above $US140 a tonne has bolstered the prospects for the Australian dollar, which economists predict could hit US70¢ by the end of the year.

Peter Dutton was flown by a billionaire to Gina Rinehart’s Pilbara party – where he had a message for parents

Federal opposition leader told audience at Roy Hill mine that parents and teachers should instruct children about benefits of mining. In a speech at Hancock Prospecting’s Roy Hill mine in November last year, Dutton repeatedly thanked those working in resources. He described the work carried out at the mine as a “national treasure”.

Don’t Dump Mining Money

In the State Budget, royalties contributed over $12bn in 2022-23. Mining represents around one-third of State Government revenue. Federally, ATO data reveals that the mining industry contributes more than $40bn in company tax — around 5 per cent of ALL company tax paid in Australia in the 2021-22 financial year. This remarkable contribution should not just be seen in terms of abstract numbers. Mining not only represents jobs and growing wealth, it also represent money for schools and hospitals, defence funding, investment in new roads and other infrastructure, and on and on.

Iron ore steals the show in gift for Budgets as lithium loses steam

“Reduced global supply of energy commodities following the implementation of Russian sanctions (over its invasion of Ukraine) has raised the vulnerability of gas/LNG/coal prices to supply outages and demand spikes,” it said. “As such, there is more uncertainty than in the past around how energy prices may develop through the northern hemisphere winter and summer demand peaks.” LNG export earnings are seen benefiting from higher prices in recent months, with the annual forecast lifted $2b to $73b, down from $92b last financial year. It remains Australia’s biggest resource earner behind iron ore, with metallurgical and thermal coal set to place third and fourth on $52b and $36b respectively.

Billionaire’s sweetener in pursuit of $1b project

Billionaire Chris Ellison has promised a sweetener as he pursues official backing for a huge gas export project, offering the State Government the right to redirect gas heading overseas to the local market in the event of a shortage. Mr Ellison’s Mineral Resources hopes to build a $1 billion plant at the Lockyer field in the Perth Basin, but he has warned the project can’t go ahead at that scale without an allowance to export most of the gas. His pledge comes one day after the Australian Energy Market Operator revealed a worsening shortage of the critical fuel in WA, with 27 per cent of demand likely to go unmet by 2033.

Big miner lauds WA reforms after premier cooks greenies

West Australian Premier Roger Cook says his government will continue to help fund the Environmental Defenders Office despite his veiled swipe at the organisation and green groups for dividing Aboriginal communities to block major projects. The mining and resources industry, including Gina Rinehart’s Hancock Prospecting, welcomed the Cook government’s proposed overhaul of environmental approvals on Wednesday, which the premier launched a day earlier along with his broadside at green groups.

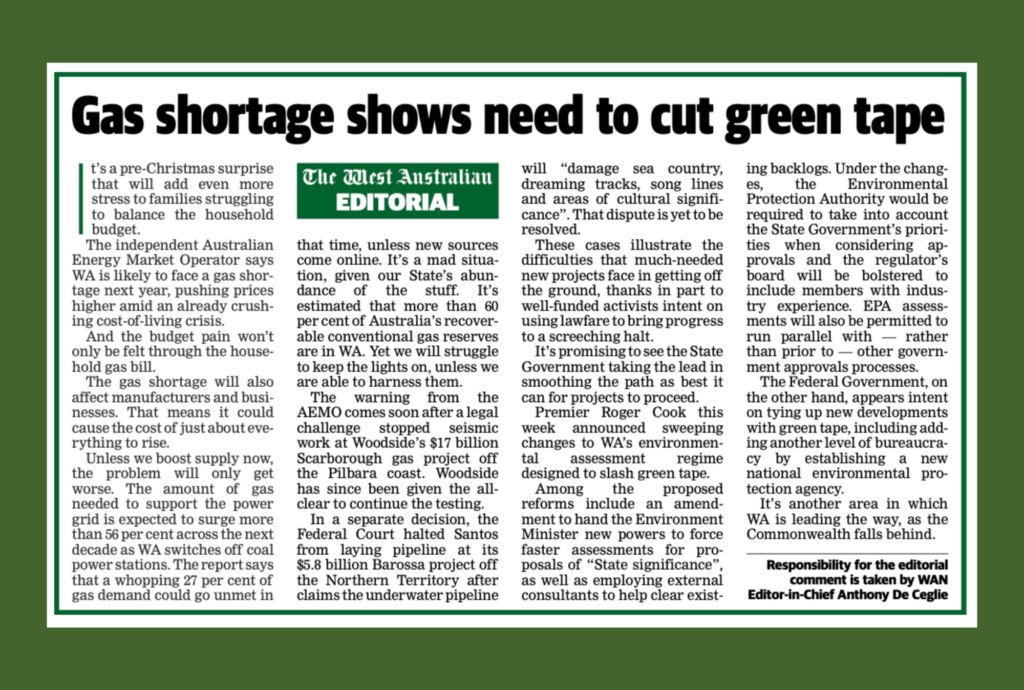

Editorial: Gas shortage shows the need to cut green tape

It’s a pre-Christmas surprise that will add even more stress to families struggling to balance the household budget The independent Australian Energy Market Operator says WA is likely to face a gas shortage next year, pushing prices higher amid an already crushing cost-of-living crisis . And the budget pain won’t only be felt through the household gas bill. The gas shortage will also affect manufacturers and businesses. That means it could cause the cost of just about everything to rise.

MEDIA RELEASE | Amendments make IR Bill worse, not better | MINERALS COUNCIL of AUSTRALIA

2023 | Statement from Tania Constable, Chief Executive Officer

TAX WHACK ON SUCCESS, COSTS KEEP A LID ON GROWTH HOPES

Seven in 10 WA businesses are struggling to find workers for specific skills as they battle what the State’s leading business group has described as a “tax on success”.Rising operating costs are being fuelled by what the chamber calls the State’s excessive payroll tax burden — hitting small and family businesses hardest. “We know that WA pays the highest payroll tax in the country, despite the fact that our State’s finances are the best in the nation,” CCIWA chief economist Aaron Morey, said.

Farmers Wary of IR Bill

A nationwide overhaul of industrial relations laws has passed through the House of Representatives, angering farmers who had urged Federal Labor to take the “catastrophic” legislation back to the drawing board.