News

Editorial: WA must fight against ‘Victorian’ IR laws | Don’t let a group of Victorians decide what’s right for you

Gerhard Veldsman, chief executive of Roy Hill, is the latest business leader to sound off on the “same job, same pay” IR laws, telling the Minerals Week conference in Canberra the overhaul would force miners to shift staff to “minimum award standards”. “Don’t let a small group of people out of Victoria that has never set foot on a mine site decide what’s good for you,” Mr Veldsman, pictured, told the crowd, adding the mining sector already paid nation-leading salaries. “We work together to make the industry better and then we make sure that when mining does well our employees share in it. Same job, same pay threatens to take this away and force us back to minimum award standards.”

HON PETER DUTTON MP | ADDRESS TO THE MINERALS WEEK LUNCH

TRANSCRIPT | CANBERRA | 6 September 2023

IR war: New business ads warn laws will ‘make cost-of-living worse’

Australia’s biggest employer groups will fire a new salvo against the Albanese government’s industrial relations shake-up on Wednesday, launching a multimedia advertising blitz warning the IR overhaul will make the cost-of-living crisis worse. The Find a Better Way campaign, backed by mining, farming, building, recruiters, big and small business groups, says Labor’s same job, same pay laws are “not about equal pay for men and women and it’s not about closing loopholes”. The ads, filmed on a construction site and farm, carry the slogan “the bill all Australians will have to pay” and raise concerns about higher costs for homebuyers, renters and shoppers. “It means that subcontracting work essential for tradies and builders will be less flexible and less efficient, making building more expensive.

‘Gas the hero, not the villain, in the green transition’

Don’t talk to Adam Watson about gas going the way of coalfired power. The boss of Australia’s gas pipeline and storage heavyweight APA isn’t afraid to advance the cause of the fuel that is fast becoming the new battleground in the green energy wars. But Watson argues gas is now a more important partner than ever in building Australia’s renewable energy grid.

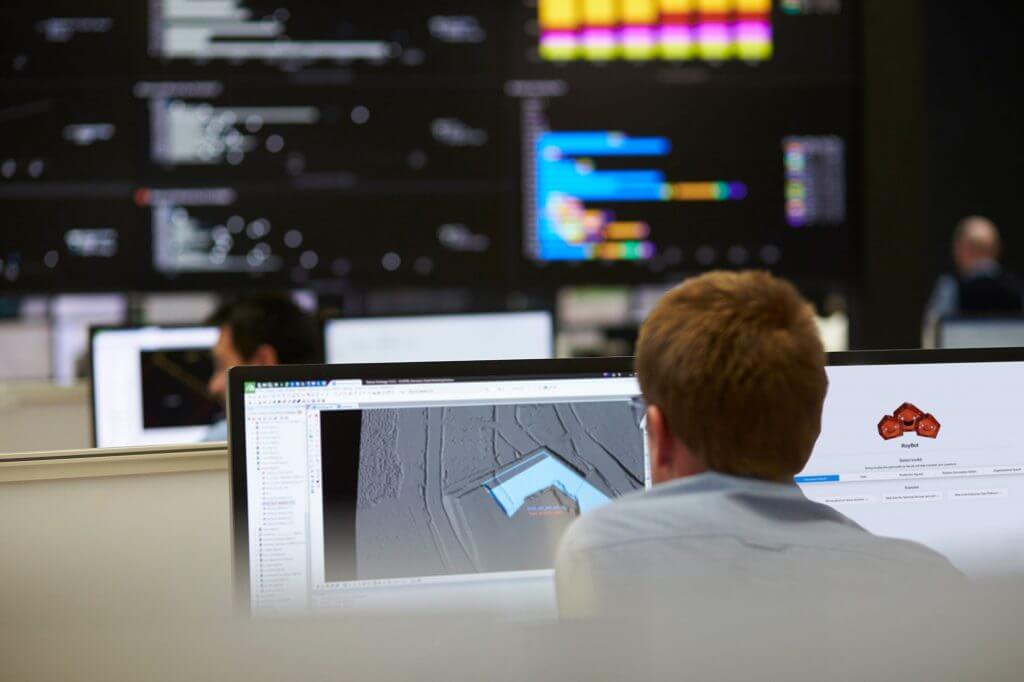

Introducing RoyBot: Roy Hill’s innovative AI tool boosting employee productivity at scale

In late 2022, Roy Hill Executive Chairman Gina Rinehart encouraged her leaders at the West Australian iron ore mining company to start using the artificial intelligence (AI) chatbot, ChatGPT, to increase their personal productivity. These productivity gains made a strong impression, and the company began considering how a similar, customised application rolled out across Roy Hill’s entire workforce might improve employee productivity at scale. The system is designed to respond to a broad spectrum of inquiries related to production data, company policies and procedures, as well as general HR information. Roy Hill’s employees interact with RoyBot using natural language, asking questions through the internal web application.

Sovereign energy risk is real

I can sense panic is starting to set in behind the scenes in the Federal and the east coast State governments on the energy front. On one hand they have so successfully demonised fossil fuels and created unrealistic expectations on the time lines for the transition to large-scale renewable sources. But on the other hand they are loving the massive growth of revenues flowing into their treasuries from the very same fossil fuels both during and after the COVID lockdown years. The world is demanding more, not less, electricity but people want it generated and distributed in a more environmentally friendly way.

SANTOS IN PUSH FOR MORE WA GAS SUPPLY

Santos boss Kevin Gallagher warns new supply is urgently needed in WA if the State wants to avoid an east coast style gas shortage . Speaking to The West Australian after the gas giant’s interim results, Mr Gallagher, said State and Federal Governments needed to ensure investments can stack up and bring more supply online. His comments come amid rising gas prices in the WA market and concerns there is not adequate supply from existing projects , despite the State’s reservation policy.

Opening the gates | Ideas for an even greater country | Gina Rinehart AO

My father throughout his whole life was a huge lover of the bush and of our country, and made himself unpopular at times, standing up for what he could see was in the nation’s best interests. On our long drives together in the bush to check windmills and cattle – I was the gate opener and tool carrier – Dad would sometimes tell me jokes. One he especially liked was told by Dr Edward Teller – scientists who knew both Teller and Einstein said that Teller had the greater mind.

BHP’s big jump in capex spending a sign of green times

Among the key takeaways from BHP’s full-year results on Tuesday was a massive increase in the miner’s capital expenditure plans, from $US7.1 billion ($11b) this year to around $US10b next year, with the medium-term outlook for $US11b. An increasing proportion of this — around 70 per cent — will go towards so-called “future facing commodities” needed for the energy transition, along with initiatives to cut emissions across its sprawling operations.

Let Pensioners Work

“Age-old problem needs future-proofing” is missing an important component in the worker shortage debate, the harsh treatment by the Federal Government of aged Australians and other pensioners who would otherwise like to continue working.Let’s look after our own better and remove the incomes test. Allow those pensioners who would like to, including veterans, contribute to the prosperity of us all. This initiative will assist with the current housing crisis and cost-of-living issues as well. | Dean Nalder

LISTEN TO THE BUSH LEADERS

I listened intently to them as well as to Gina Rinehart who gave her views on what governments need to do to ensure we continue to enjoy the lifestyle we have grown accustomed to. My personal view is our governments need to listen to the Rinehart has to say. We need successful business leaders and philanthropists with common sense and a love of our country more than ever to give advice to our leaders.

‘This is a very big issue’: Mining magnate Gina Rinehart takes aim at net zero policy, calls for more practical policies

Gina Rinehart has offered a scathing assessment of the costs involved with achieving net zero at a regional summit, warning of the dire consequences for the agriculture industry. Ms Rinehart took aim at the handouts for “climate research and government advisers”, highlighting the angst she sees in the agriculture industry. “The type who have never successfully run a farm, a station, or other agriculture businesses,” she told the regional Queensland crowd. “I think we are also not looking at the costs involved with the agriculture industry.”