News

STOP BEATING AROUND THE BUSH ON REGIONS

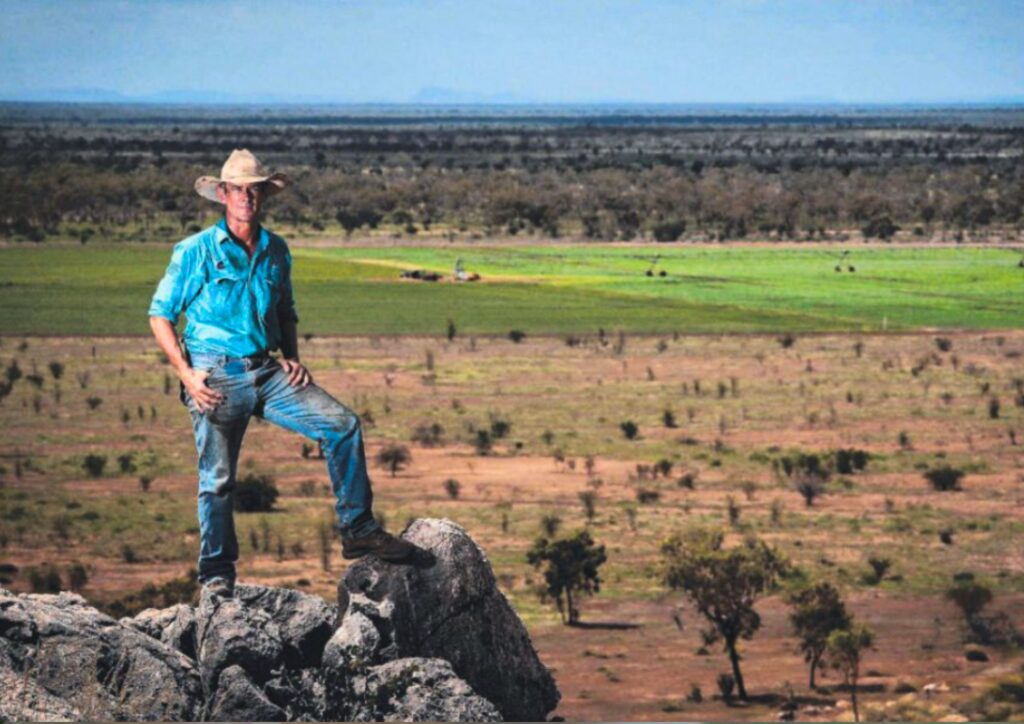

While business leaders and policymakers were converging in Perth on Monday for The Australian’s inaugural Bush Summit, more than 2000km away, in the state’s remote Kimberley region, pastoralist Chris Towne and a group of workers were battling to contain a massive fire sweeping across the plains of Gogo Station. Once again, the task of dealing with the blaze had fallen to Towne and his employees. And once again, there had not been any action taken against those suspected of starting the fires“If this was bushland outside Perth it would be front page news.” Towne’s experience in many ways encapsulates the sentiment expressed by many at the Bush Summit: that Western Australia’s regions feel forgotten and ignored.

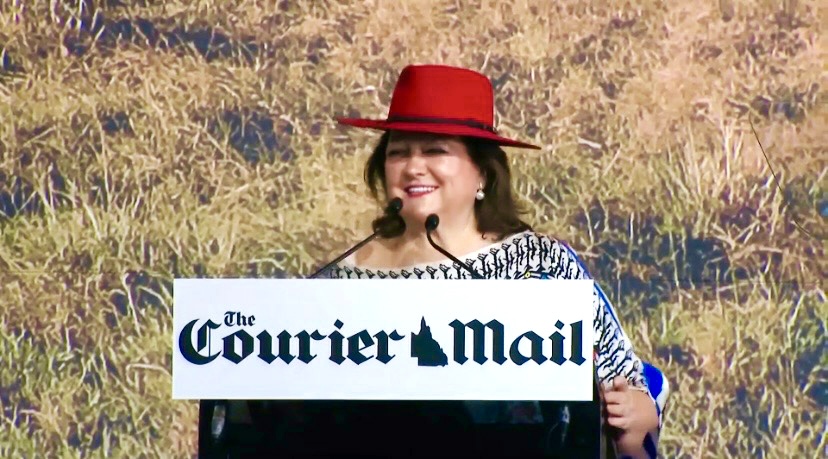

The Courier-Mail Bush Summit 2023: Keynote with Mrs Gina Rinehart AO

Keynote speech with Gina Rinehart, Executive Chairman, Hancock Prospecting Group.

RINEHART ALARM ON NET ZERO TARGETS

Hancock Prospecting executive chair Gina Rinehart says the costs to agriculture of achieving net-zero targets has the potential to increase food prices at the supermarket and force farming families off their land. Ms Rinehart, in her keynote speech at The Courier-Mail Bush Summit, also sounded the alarm on red tape associated with mining which she said could take “decades” to navigate.

Gina Rinehart’s personal tragedy a win for City of Perth Government news

“I had no doubt that through the determination and commitment of our people at Roy a solution could be developed which will have a lasting and significant safety legacy in Perth,” Mrs Rinehart said. “Hancock Prospecting and Roy Hill has a fantastic association with the Lord Mayor and the City of Perth, and this is another significant achievement we can be proud to have worked together to deliver.”

Gina Rinehart’s bold vision for Australia’s future as she warns the country could face food shortages if nothing is done

She sent her strongest message about the expensive bill farmers were facing to meet zero emission CO2 targets. Her Hancock Agriculture business runs 14 farm properties in Western Australia with 12,000 head of Wagyu beef cattle, one of the largest herds in the country. ‘Agriculture usually doesn’t have the financial resources that the mining industry has and this is a big thing we I think we are overlooking,’ she said. ‘It just doesn’t have the resources – unless of course you’ve got, you know, a mining company in your back pocket. ‘You’ve actually got to add up the expense of these net-zero policies on farmers. ‘Just look at acquiring electric vehicles alone,’ she added. ‘Be they for lawn mowers motorbikes utes, four wheel drives, tractors, harvesters, trucks, bulldozers, graders, front end loaders. ‘It’s going to cost a fortune that farmers and pastoralists don’t have without a mining company in the back pocket. They just don’t have this money to be able to invest.’

Gina Rinehart urges Albanese government to ease burden of net zero emissions on farmers as she calls for drastic red tape cut

The executive chair of Hancock Prospecting and Hancock Agriculture Gina Rinehart used the first Bush Summit in Western Australia to urge state and federal government to massively cut red tape, return regional revenue to the bush and ease the pain of net zero policies on farmers. Ms Rinehart delivered the keynote address at The Australian’s summit in Perth on Monday where she offered a list of key reforms to improve the lives of rural Australians.

Iron ore price falls on worries of steel output cut in China

Iron ore prices fell on Monday as expectations of steel output cuts in China and weakness in the country’s property segment weighed on sentiment. The most-traded January iron ore on China’s Dalian Commodity Exchange dipped 0.4% to 725 yuan ($99.88) per metric ton.“[Citi’s] industry discussions suggest that crude steel control targets will likely be finalized by August 15, and local governments and mills could make their own production control plans thereafter,” the bank said in a note, mirroring earlier concerns from the southwestern Yunnan province.

Farmers can’t afford net zero, says Rinehart

“It’s going to cost a fortune that farmers and pastoralists don’t have, without a mining company in their back pocket. They just don’t Australia’s richest person, Gina Rinehart, says farmers and the agriculture sector cannot afford the transition to net zero and governments should step in to cover most of the costs. this money to be able to invest.”

Roy Hill sets up chatbot to help lift productivity

West Australian mining company Roy Hill has developed its own internal chatbot to give its employees better insights about the company’s functions and to increase their personal productivity. The program was developed after executive chairman Gina Rinehart put out a challenge 18 months ago for the leaders of WA mining companies to use AI to help increase productivity. “The system is designed to respond to a broad spectrum of inquiries related to production data, company policies and procedures, as well as general HR information,” Roy Hill said in a statement. “Roy Hill’s employees interact with RoyBot using natural language, asking questions through the internal web application.”