Article byKeira Wright, Sing Yee Ong, Will Mathis, and Will Wade, courtesy of Bloomberg

30.07.2025

Australia’s long-held ambitions to tap its abundant renewable resources and vast uninhabited landmass to become a global green hydrogen leader are fast unraveling.

Despite strong government backing and significant private sector interest, at least seven big hydrogen production projects have been delayed, scaled back, or canceled in the last year. Chief among them was BP Plc’s decision last week to exit a $36 billion facility in the Pilbara region of Western Australia, which had targeted starting production this decade.

BP Exits $36 Billion Hydrogen Project

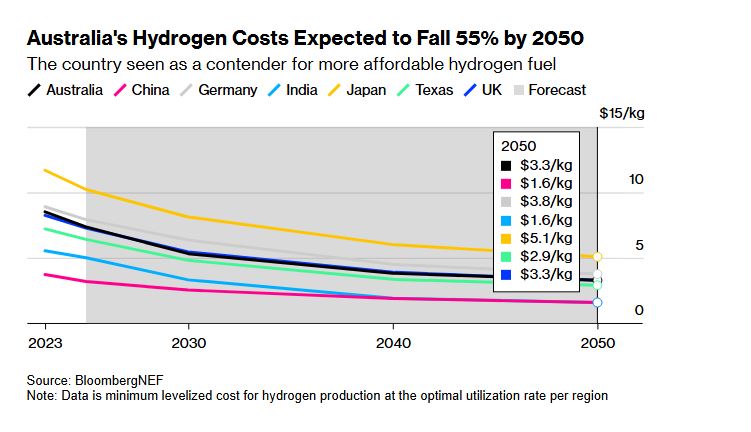

Around the world, project withdrawals have accelerated as developers struggle to secure customers willing to pay a premium for the fuel. Costs remain persistently high, unlike the sharp price drops seen in solar and wind that have boosted their competitiveness.

That’s raised concerns about the feasibility of using renewable energy to produce hydrogen that can be stored, transported and consumed like a fossil fuel to help nations meet net zero goals. It also looks set to make Asia’s goal of cutting hard-to-tackle emissions tougher to achieve.

“This isn’t just an Australian issue — there has been a slowdown in development globally, in large part because the cost hasn’t come down as fast as previously forecast,” said Simon Nicholas, an analyst at The Institute for Energy Economics and Financial Analysis, a think tank that seeks to accelerate the energy transition. “I hope that the bursting of the hydrogen hype bubble is an opportunity for a reset.”

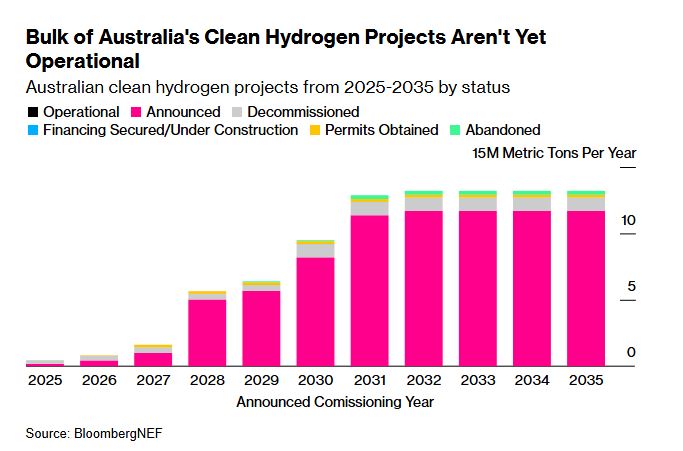

There are more green hydrogen projects under development in Australia than in any other country, with a A$225 billion ($147 billion) pipeline worth of proposed projects, according to the government. But only three relatively minor plants are actually operational in the country, while most others remain in preliminary planning stages.

In recent years, many of the largest energy companies have tempered plans for green hydrogen as a way to better scale up renewable electricity. Plans to produce about 1.67 million tons of clean hydrogen had been shelved as of the end of June, according to BloombergNEF — over five times the amount of actual capacity. Meanwhile, just 1.9% of planned projects have secured financing or started construction.

Europe, which could become one of the world’s largest consumers of green hydrogen in its push to achieve climate neutrality by mid-century, has grappled to overcome high costs, forcing some projects to be abandoned despite government support.

Growth of the technology in the US is also now in doubt after the Trump administration’s tax-and-spending legislation significantly limited tax credits to produce the fuel. A year ago, credits were expected to help lead to about 1.2 million metric tons of annual green hydrogen production by 2030, BNEF said. Now, projects with just 150,000 tons of production capacity are expected to qualify for the incentives, dramatically reducing anticipated US output.

“If those incentives don’t exist, I don’t think this industry will exist,” said Payal Kaur, BNEF’s hydrogen analyst. “There will be cancellations if the economics don’t work, and the economics don’t work without the credits.”

In Australia, the challenges come despite strong government support and some of the world’s best natural conditions to produce hydrogen using renewables. The government has committed at least A$4 billion to support the green hydrogen industry to bridge the cost gap between production and market prices. However, access to most of this funding depends on developers proving commercial viability upfront — a challenge as long-term buyers remain scarce.

The Australian Renewable Energy Agency is responsible for administering the government’s Hydrogen Headstart program and has so far provided more than A$370 million to 65 renewable hydrogen projects. The agency “appreciates that the renewable hydrogen industry is nascent and will naturally experience challenges as it scales up,” it said.

Fortescue Ltd. and Woodside Energy Ltd. said this month they would withdraw from green hydrogen plans in Australia and the US. While those announcements are disappointing, the clean fuel is essential to manufacturing and industry in a net zero future, Australian Energy Minister Chris Bowen said.

Some green hydrogen projects are still moving forward, despite the cost challenges. In Europe, climate policies are encouraging deals, such as the one between Germany’s RWE AG and TotalEnergies SE to supply hydrogen to an oil refinery. Those contracts will help to underpin new production.

Read More: Will Hydrogen Fuel a Clean-Energy Future, or Fizzle?: QuickTake

Elsewhere, China and India are pushing ahead in a race to produce some of the world’s cheapest green hydrogen. Even so, the clean fuel remains far more expensive than fossil fuels, according to BloombergNEF. For now, demand is mainly concentrated in sectors already using hydrogen, such as oil refining and fertilizer production.

China also benefits from a mature domestic supply chain of electrolyzers — the machines that convert water into hydrogen and oxygen — that has helped reduce project costs. In contrast, Australia depends on European-made production units, which cost multiples of the Chinese ones, according to Nigel Rambhujun, a hydrogen analyst at Rystad Energy.

Australia’s hydrogen dreams, meanwhile, risk being left in tatters.

The current “situation may prompt a reassessment of sourcing strategies, with greater emphasis on evaluating alternative regions,” said Shintaro Onishi, a hydrogen and ammonia analyst at Wood Mackenzie. The researcher has already incorporated a “limited future role of Australian hydrogen exports” in its outlook, he said.