Article by Lisa Uhlman, courtesy of Proactive

12.08.2025

The first hole of the latest infill program, CVDD24-141, cut:

- 31.6 metres at 2.2 g/t gold, 5.4 g/t silver from 70.9 metres, including 8.8 metres at 3.8 g/t gold, 10.6 g/t silver;

- 18.1 metres at 1.4 g/t gold, 2.9 g/t silver from 145 metres, with higher-grade zones up to 3.6 g/t gold; and

- 23 metres at 1.4 g/t gold, 5.4 g/t silver from 173 metres, including 8 metres at 2.6 g/t gold, 12.1 g/t silver.

The hole also ended in mineralisation, returning 4.3 metres at 2.1 g/t gold, 6.1 g/t silver from 274.6 metres.

Cerro Verde long section A-A’ looking northeast (150m window), drilling shows Au g/t histogram in red, conceptual pit optimization (US$1850/oz), interpreted mineralised zone, significant drilling intersections and potential mineral resource additions.

Titan said the intercepts came from a previously untested gap zone between the Brecha-Comanche epithermal gold system and the Kaliman porphyry copper-gold system, highlighting strong growth potential in this part of the prospect.

Infill drilling delivering

The ongoing 6,000-metre diamond program is focused on resource conversion drilling at Cerro Verde, which hosts nearly two-thirds (1.9 million ounces) of Dynasty’s 3.1-million-ounce gold resource. The company believes the higher drill density will likely define new mineralisation in areas currently classed as waste within conceptual open pit designs — potentially improving future pit optimisation, mine studies and strip ratios.

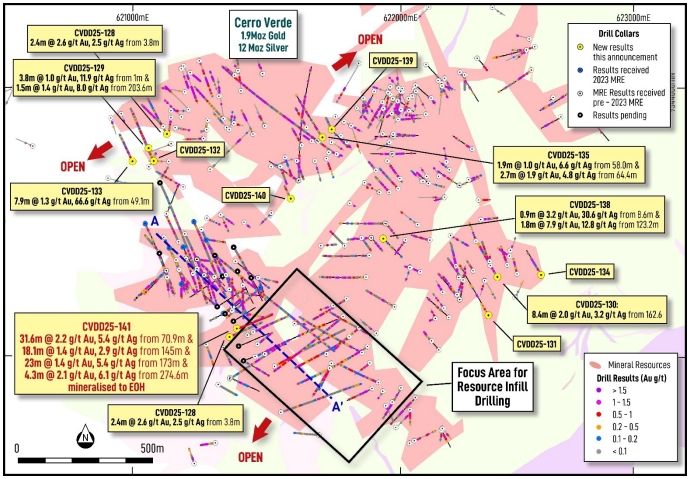

Cerro Verde plan view displaying mineral resources, geological interpretation, drilling (Au g/t), latest results and location of cross section A-A’

Recent assays from earlier drilling in the program have also confirmed near-surface extensions, including:

- 2.4 metres at 2.6 g/t gold, 2.5 g/t silver from 3.8 metres (CVDD25-128);

- 7.9 metres at 1.3 g/t gold, 66.6 g/t silver from 49.1 metres (CVDD25-133); and

- 1.8 metres at 7.9 g/t gold, 12.8 g/t silver from 123.2 metres (CVDD25-138).

Confidence on growth trajectory

Titan CEO Melanie Leighton said the company was pleased about the “exceptional” results in proximity to its current resource as it continues defining extensions to mineralisation, which she said “augers well for our early development studies at Dynasty”.

“To be the 100% owner of such a substantial and growing multi-million-ounce gold-silver project puts Titan in the box seat amongst our junior ASX peers,” Leighton said.

“We have three drill rigs churning at Dynasty, while our JV partner, Hancock Prospecting, is busy drill-defining large-scale copper porphyry mineralisation at our Linderos Project,” she added. “We believe that Hancock’s exploration work at Linderos can be a potential game changer for the company.”

She added that a recent uptick in foreign investment in Ecuador underlined an “exciting period of value creation” ahead for Titan and its shareholders.

Next steps

Drilling at Cerro Verde will continue over the next three months, with resource consultant Entech Mining due to visit the project in August as part of the Mineral Resource Estimate due diligence process.

The 139-square-kilometre Dynasty project hosts a nine-kilometre-long epithermal system and potential porphyry copper mineralisation at several prospects, providing Titan with multiple avenues for resource growth alongside its development studies.

Dynasty Gold Project displaying simplified interpreted geology, resources and prospect locations.

.jpeg)

.jpeg)