News

Bob Hawke on nuclear power

“Nuclear power would be a win for the environment and an essential part of attacking global warming.”

Red tape, costs kill MinRes mine

Lengthening approvals processes and rapid cost escalation has forcedMineral Resources to shutter its iron ore operations, according to thecompany’s iron ore boss, rather than concerns about the outlook for thesteelmaking commodity.

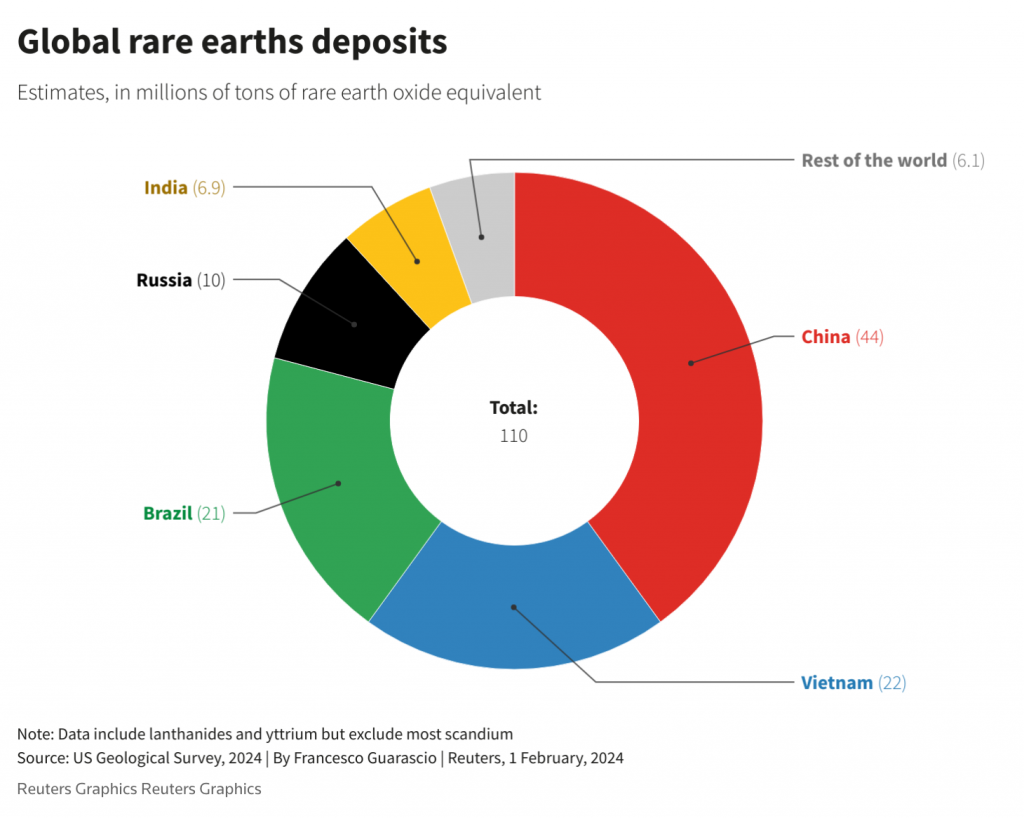

Brazil joins race to loosen China’s grip on rare earths industry

Mining giant Brazil has big ambitions to build a rare earths industry as Western economies push to secure the metals needed for magnets used in green energy and defence and break China’s dominance of the supply chain.

Hancock Prospecting named presenting partner of News Corp’s 2024 Bush Summit

Gina Rinehart said Australians are “truly fortunate to be able to enjoy the high quality of the agricultural products our farmers work so hard to produce.”

Economic storm clouds warrant a policy rethink

Too many aspects of economic policy, unfortunately, are heading in the wrong direction. The government should look at foundations set in the Hawke-Keating and Howard years and attend to basics, optimising conditions to encourage private sector investment, profit, employment, productivity gains and growth. Policies that limit the footprint of government by reducing regulation, holding down company tax and payroll tax at state levels, and giving employers and workers greater autonomy to negotiate work practices, pay and benefits to suit their industries would be a basis for reviving growth.

Call to reform Mabo’s $1bn native title dividend

Native title groups hosting Australia’s iron ore industry are holding more than $1 billion of net assets in trusts, but after 30 years of the native title regime, there is little to show for the vast majority of Indigenous Australians.

Plibersek’s new environment laws friendless

Tanya Plibersek’s bill to create a new environmental watchdog has fallen flat with business, conservationists and the Greens, and looks set to face opposition from key crossbenchers in the Senate.

Tanya Plibersek unveils Labor’s new nature cop as doubts surround future of Nature Positive plan

Environment Minister Tanya Plibersek has unveiled Labor’s new nature cop to a storm of criticism, as doubts surround the future of the third and most contentious piece of her Nature Positive plan.

Concerns laid bare as EPA Bill tabled

The Business Council of Australia has outlined fresh concerns over the remit of a federal Environmental Protection Agency, after a Bill was introduced to parliament today.

Gas producers deny shortage and demand faster approvals

Victoria’s gas companies have declared there is no shortage of local reserves to fill shortfalls… while blaming state and federal governments for lengthy delays in project approvals.

The need for energy investment is obvious and pressing

With the federal government’s recently released Future Gas Strategy making clear the critical, long-term role for gas in this country, the need to encourage investment in the development of Australia’s gas resources is obvious and pressing.

Pipeline Review Puts Gas on Hold

A major gas expansion seen as vital for Australia’s southern states to avoid shortages in the next two years has been put on hold due to a tough regulatory clampdown, with the fresh supply shock landing just days after the Albanese government warned of shortfall risks this decade.